You provide the account,

we power the technology

Business checking has not kept pace with the needs of business owners.

Traditional accounts do the job of holding deposits, but busy owners need an account experience that supports their daily financial workflows — not one that simply keeps a balance.

A bank-owned account experience built for small businesses.

Payments, accounting, and financial reporting are integrated directly into your business checking lineup.

You control the customer relationship, pricing, and go-to-market strategy.

Autobooks powers the technology and delivers ongoing enhancements that help business owners manage their day-to-day within your institution.

The Market Opportunity

109M

36M small businesses and 73M independent workers operate in the United States

91%

earn less than $1M annually and most employ fewer than four people

65%

of small businesses use fintech tools because their bank does not offer what they need

Upgrade your business checking experience to attract more small businesses and deepen primacy with existing relationships.

Why Business Checking

Needs an Upgrade

Traditional business checking was built for a paper-based world, where cash and checks dominated and monthly item limits defined account tiers. That structure no longer fits the realities of digital-first businesses that accept cards, send online invoices, and expect real-time visibility into their cash flow.

Non-bank competitors now embed financial services directly into their platforms, capturing deposits, loan activity, and payment volume that once belonged to financial institutions.

Autobooks Smart Checking brings that functionality to your institution, giving you the modern account experience small business owners value.

A Better Small Business Checking Experience

Bundle modern small business tools directly into a checking account you control. You define how the account is positioned, packaged, and billed.

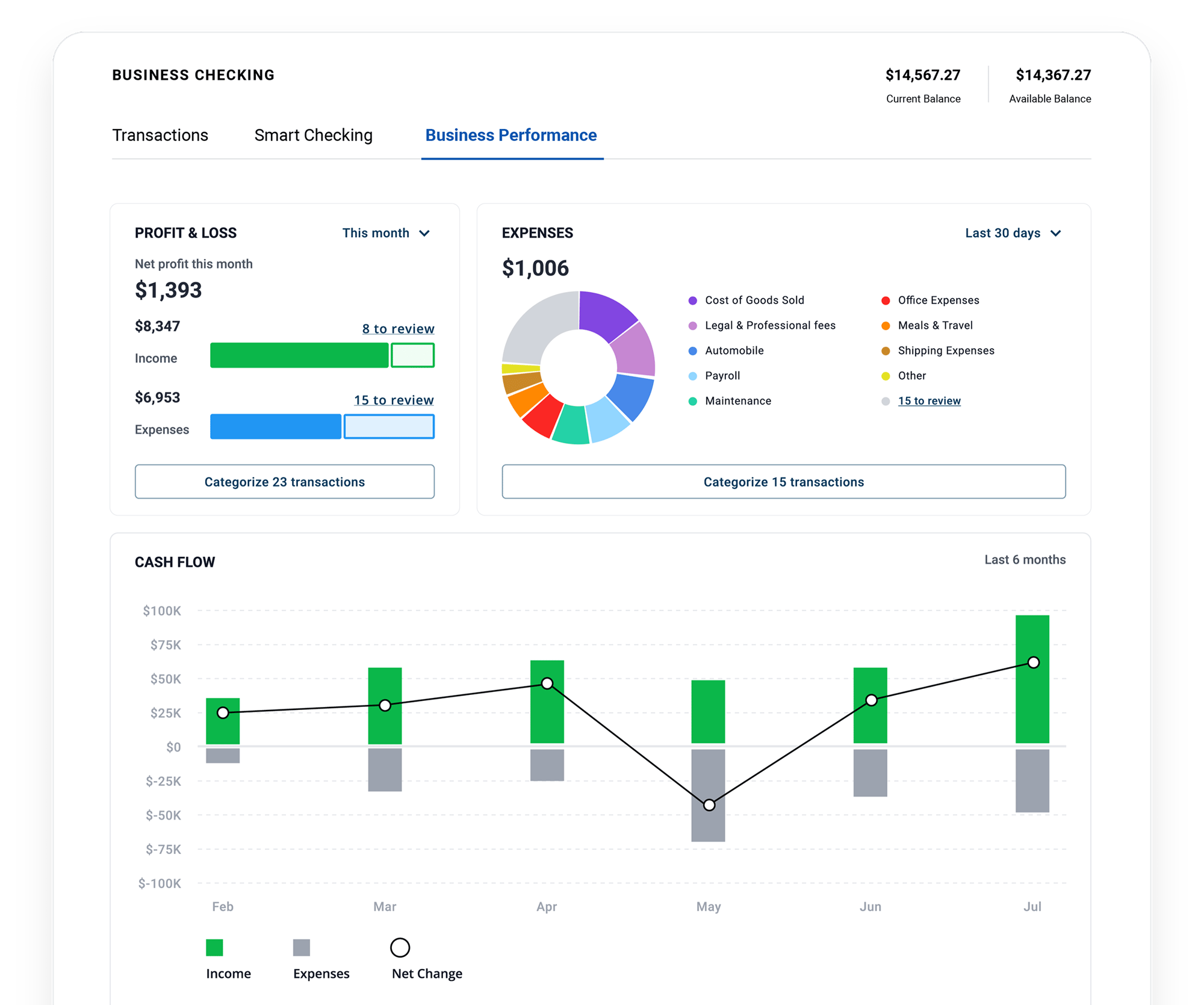

Embedded Accounting and Reporting

Give customers real-time visibility into income, expenses, and cash flow directly within their account. Business owners can categorize transactions, generate financial reports, and understand performance without leaving their banking experience.

Integrated Payment Acceptance

Enable businesses to send invoices or share a payment link so they can accept card or ACH payments directly into their checking account. Modern payment acceptance becomes as standard as remote deposit capture or bill pay.

Dynamic Advance Line

Offer qualified businesses a working capital advance based on their receivables and cash flow data. Keep smaller lending relationships in-house by offering timely, data-driven access to capital.

Unified Financial Workflow

Bring invoicing, payables, accounting, and reporting together in one seamless experience. Reduce reliance on third-party apps and strengthen deposit primacy with an account that becomes part of the business’s daily workflow.

The Competitive Edge

Differentiate your

checking lineup

Deliver built-in tools that small business owners value most.

Increase account

primacy and retention

Offer daily-use functionality that keeps deposits and transactions within your institution.

With Autobooks Smart Checking, your account becomes more than a place to store funds. It becomes the platform your business customers rely on to manage and grow their operations.

Transform Your Business Checking Lineup

Bundle Autobooks-powered functionality into your checking lineup to stand out from the competition and drive account primacy. You provide the account, we provide the technology.

Basic Business Checking

Securely accept payments and manage your account online

$0/month

Small Business Checking

Manage your accounting, access financial reporting, and more directly from online and mobile banking

$25/month

Non-profit Checking

Accept online and in-app donations with a reduced processing rate

$25/month

Premier Business Checking

Business checking with advanced payment, lending, and treasury management features

$50/month

-

Debit card

-

Online & mobile banking

-

Online banking statements

-

Online bill pay

-

Debit card

-

Online & mobile banking

-

Online banking statements

-

Online bill pay

-

Debit card

-

Online & mobile banking

-

Online banking statements

-

Online bill pay

-

Debit card

-

Online & mobile banking

-

Online banking statements

-

Online bill pay

-

Professional invoicing

& estimates -

Secure payment links

-

In-person payments

with Tap to Pay -

Mobile remote deposit

check capture -

Merchant services

-

Professional invoicing

& estimates -

Secure payment links

-

In-person payments

with Tap to Pay -

Mobile remote deposit

check capture -

Merchant services

-

Accept online and in-app donations

-

Reduced non-profit processing fees

-

In-person payments

with Tap to Pay -

Mobile remote deposit

check capture -

Merchant services

-

Professional invoicing

& estimates -

Secure payment links

-

In-person payments

with Tap to Pay -

In-office check scanning

-

Merchant services

-

ACH payments

-

Wire payments

-

Integrated transaction categorization

-

Real-time profit and loss

-

Real-time balance sheet

-

Customer payment reporting

-

Third-party

accounting support

-

Integrated transaction categorization

-

Real-time profit and loss

-

Real-time balance sheet

-

Customer payment reporting

-

Third-party

accounting support

-

Third-party accounting

& ERP support

-

In-app working capital application and approval

-

In-app working capital application and approval

-

In-app working capital application and approval

-

Business line of credit

- SBA lending

-

ACH positive pay

-

Check positive pay

-

300 transactions/month

-

$.50 per transaction after

-

450 transactions/month

-

$.50 per transaction after

-

450 transactions/month

-

$.50 per transaction after

-

600 transactions/per month

-

$.50 per transaction after

Powered by Autobooks

* Advance line eligibility based upon account tenure, average deposit, and transaction history

Upgrade your business checking.

Strengthen your relationships.

Because the account should do more than hold money; it should help run the business.

Schedule time with an Autobooks team member to discuss:

- Migrating free business checking, and businesses within free retail accounts, account, into a business checking account worth paying for.

- Integration options with your digital banking provider.

- Deposit impact of enabling integrated receivables and working capital solutions within business checking.

- Reduce treasury team workflow by offering a purpose-built, self-service solution for small businesses.