Enable Autobooks Enterprise inside CSI digital banking at no cost.

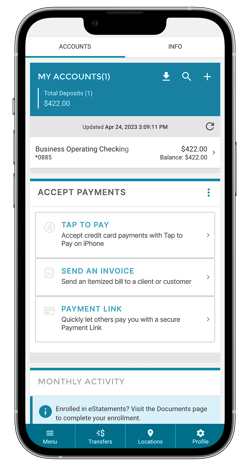

Offer your small businesses an easy way to send digital invoices, get paid, and manage

finances directly from your CSI-powered online and mobile banking channels.

Want to learn more about Autobooks?

About Autobooks

Today, small business owners and independent workers are turning to third-party providers for a variety of financial needs, which most often makes their workflows harder to manage and more expensive to maintain. That's why Autobooks is on a mission to simplify digital banking and bring the customers back where they belong: with their financial institutions.

We make it easy for financial institutions like yours to access and offer market-ready tools built for small businesses — right inside your CSI-powered digital banking channel.

Accept digital payments, including all major credit cards.

Send professional invoices, with the ability to customize them.

Get paid directly into their account, where they can access funds easily.

Manage cash flow, automate reporting and bookkeeping, and more.

Check out what's included in your free upgrade.

Autobooks Enterprise

Autobooks makes it simple for your financial institution to launch and manage an upgraded small business banking experience.

Grow your small business portfolio through data-driven insights and additional customer service features. Autobooks Enterprise includes all features and services offered in Autobooks Embedded.

Included for CSI financial institutions, at no additional cost:

Customer Features

Invoicing

Payment Acceptance

Accounting

Reporting

Cash Flow Management

Tap to Pay on iPhone

Financial Institution Back Office

Customer Reporting

Payment Acceptance

Support Ticket Management

Knowledge Base

Customize Reporting

Customize Dashboards

Referral Management System

Unlimited Admin Users

Marketing

& Training

Access to Launch Sprints

Pre-build Marketing Campaigns

Launch Training Videos

Knowledge Base

Assigned Implementation Specialist

Training Video Library

Embeddable LMS Modules

Ready to learn more? Contact Us

Four steps to a successful program

Offering integrated invoicing and online payment acceptance to your customers is a straightforward affair — thanks to the resources found here. Just follow the four steps below to ensure your Autobooks program is successful.

Step 1: Prepare to go live

1.1

Request access

Contact your representative at CSI to get set up with the correct access and data sharing through your partnership.

Enable Autobooks within CSI Digital Banking

The following guide covers how to enable users for the Autobooks service within digital banking.

Complete and submit the Autobooks forms below:

Complete the Operational Form

We need to know who to contact to best serve your team moving forward. This includes assigning your first team member with admin access to the Autobooks Hub, a tool that provides reporting to best serve your customers and successfully manage your program.

1.2

Learn about Autobooks features & tools

Autobooks Feature Demos

A catalog of the most commonly used features of the Autobooks product suite.

Autobooks Hub

Our data-driven platform is crucial to maintain a successful program. Easily track Autobooks usage, ROI, and third-party competitor activity inside your financial institution.

1.3

Join our next Launch Workshop

Set your institution up for success

Along with the two live, one-hour sessions, all attendees will receive ongoing support and resources — including scheduled deep dive session, step-by-step coaching and resources to get your program started right, promotional marketing materials, and more.

Autobooks Launch Workshop

Complete a launch with as little as two hours of commitment a week

1.4

Notify and Train your internal team

Send your team to attend a live training we facilitate, or if you prefer to train your team internally, we provide all the resources to download and use.

Autobooks Training Resources

Webinars, reference materials, internal go-to-market collateral, and more are all available on our training page.

Internal Presentation

Download our ready-to-use internal slide deck to rally stakeholders and build internal excitement for the project.

Step 2: Configure & Test

2.1

CSI and Autobooks have already completed the configuration. Once confirmed on your end, you're ready to enable for customers.

Enable your Autobooks Program Profit Share

For many financial institutions, profit share is available for your Autobooks program. In order for Autobooks to be able send Profit Share payments, we require a completed ACH authorization form for your financial institution.

Getting Started Testing Guide

Discover how to configure and enroll a test user for Autobooks with our comprehensive testing guide. Explore Invoicing, Payment Link, Tap to Pay on iPhone, and our Accounting & Reporting functionalities.

Partner Success Center

Have a Question? Refer to our partner knowledge base to access information on all things Autobooks.

Step 3: Announce Your Launch

3.1

Market the new tool to your customers

Once you're live, marketing to your small business customers is key to drive feature awareness, engagement, and activation. We built free, proven marketing materials for your financial institution to use.

Marketing Resource Kit: Autobooks Launch Announcement

Prepare a marketing campaign to announce the availability of Autobooks to your customers so they know about their new digital banking tool — and how to use it.

Marketing Resource Kit: Tap to Pay on iPhone Update Announcement

Quickly get the word out that Autobooks is now available without the need to pay any additional fees — and also includes Tap to Pay on iPhone

3.2

Plan for on-going campaigns

Financial institutions that see the best results execute ongoing marketing campaigns to drive awareness.

Autobooks Annual Marketing Calendar

Our annual marketing calendar is organized by quarters, to make it easier to organize a campaign at your financial institution. Please note that some campaigns are tied to seasonal events and Holidays, and may span multiple months.

Additional Go-to-Market Resources

Access evergreen marketing assets, videos, templates & campaigns to plug into your existing marketing initiatives.

Step 4: Manage Your Program

4.1

Access the Autobooks Hub & Stay Up-to-Date

Autobooks Hub

Log into the Autobooks Hub regularly to monitor the activity of your program. This allows you to measure success, identify new targets, and fine tune how you're talking to your small business customers that will benefit from online payment and digital invoice functions.

Autobooks Product Updates

Visit to learn about the latest product enhancements from the Autobooks team. We also include small business feedback and data insights that influenced each update.

Included at no cost as part of Autobooks Enterprise

Tap to Pay on iPhone

Be one of the first financial institutions in the country to offer Tap to Pay on iPhone.

With Tap to Pay on iPhone and Autobooks, small business customers can accept in‑person, contactless payments right on their iPhone — directly inside your mobile banking app. No extra terminals or hardware needed.

Tap to Pay on iPhone is an add-on module to the Autobooks product suite. If you would like more information about enabling Tap to Pay on iPhone for your customers, learn more and sign up now.

Tap into a new way to better serve and monetize small business relationships.

Get started with

Tap to Pay on iPhone

Tap to Pay on iPhone works seamlessly with Autobooks, a digital payment acceptance solution already integrated within the CSI digital banking platform.

Once your mobile banking app is enabled with Tap to Pay on iPhone, your customers can start accepting contactless, in-person payments right on their iPhone.