Transform your small business checking.

Stand out from the competition by making Autobooks functionality a prominent feature of your most foundational business account.

Small business checking is more important than ever — but it needs a serious makeover.

Many financial institutions are now rethinking existing products and services to leverage newfound digital capabilities.

Longstanding products like small business checking are often overlooked.

Autobooks is here to change that.

Get up to speed on small business checking. Fast.

The resources found on this page were designed to help your financial institution begin the hard work of transforming your key small business account — to appeal to a new generation of small business owners.

Rethink

Reinvent

Reposition

1

Rethink

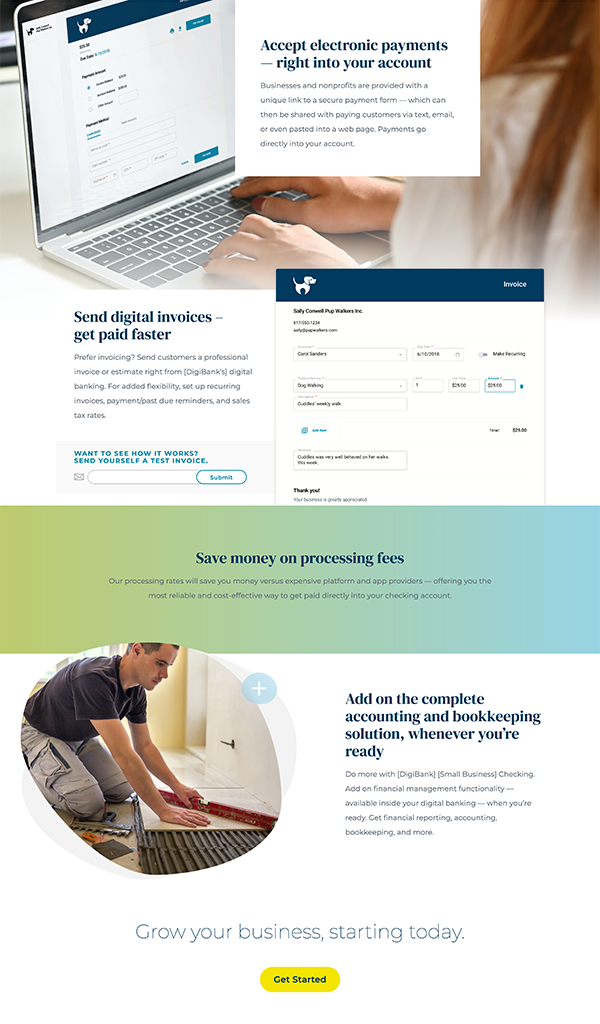

Small businesses are turning away from accepting cash and checks in person, to accepting in-app and online payments, via card and ACH. By offering these powerful tools, financial institutions can help save the day, deepening the customer relationship while gaining additional revenue streams.

To learn more, visit Help Small Businesses Get Paid.

2

Reinvent

To keep up with this shift in consumer behavior, your small business checking should prominently feature in-demand tools like digital payment acceptance and invoicing. Autobooks now enables business owners to accept online and in-app payments from inside their FI’s online and mobile banking channels, without the need to subscribe to the full solution.

To learn more, visit Upgrade Small Business Banking.

3

Reposition

It’s not enough to transform your small business accounts — now you have to tell your audience that you offer the solution they’ve been desperately searching for. To get a prospect’s attention, the messaging on the page must be explicit about the benefits the product brings (the value proposition), and how it’s different and therefore better (the product differentiators).

To learn more, download Autobooks Guide to Small Business Checking.

For inspiration: See our small business checking pages, in action.

Positioning Flow

According to positioning expert (and Autobooks consultant) April Dunford, the most effective way to convey the value proposition of a product is to begin where the prospect begins. In the case of a small business owner, it’s with the makeshift solutions they’ve come to rely on as they seek to make progress.

“We start with competitive alternatives, or what would customers do if our solution didn’t exist. Once we have that, we can ask ourselves, ‘What do we have that the alternatives do not?’ That gives us a list of differentiated features or key unique attributes. We can then go down that list and ask ourselves, ‘So what for customers?’ Put another way, what is the value those capabilities enable for our buyers?”

Based on this approach, the messaging flow for our small business checking page will follow this order:

1

The problem plaguing small businesses today

2

The alternatives they’ve come to rely on to solve the problem

3

The features/

capabilities they are actually seeking

4

Introduce the solution (your small business checking)

5

Describe its value proposition

Want to delve deeper into the ideas presented here?

Be sure to check out related small business checking resources — designed to guide your team step-by-step to building a better account powered by Autobooks.