Autobooks is available as part of your existing Banno digital banking.

Integrated invoicing and online payment acceptance are now available as free features

of Jack Henry’s Banno digital banking platform.

About Autobooks

Today, small business owners and independent workers are turning to third-party providers for a variety of financial needs, which most often makes their workflows harder to manage and more expensive to maintain. That's why Autobooks is on a mission to simplify digital banking and bring the customers back where they belong: with their financial institutions.

We make it easy for financial institutions like yours to access and offer market-ready tools built for small businesses — right inside your Jack Henry-powered digital banking channel.

Accept digital payments, including all major credit cards.

Send professional invoices, with the ability to customize them.

Get paid directly into their account, where they can access funds easily.

Manage cash flow, automate reporting and bookkeeping, and more.

Want to learn more about Autobooks?

Before you get started, we have two

options for upgrading small business banking

Digital banking tools for small businesses — program reporting and services for financial institutions

Autobooks Embedded

Autobooks Embedded makes it simple for your financial institution to launch and manage an upgraded small business banking experience.

Includes:

Customer Features

Invoicing

Payment Acceptance

Financial Institution Back Office

Customer Reporting

Payment Acceptance

Support Ticket Management

Knowledge Base

Marketing

& Training

Access to Launch Sprints

Pre-build Marketing Campaigns

Launch Training Videos

Knowledge Base

Autobooks Enterprise

Grow your small business portfolio through data-driven insights and additional customer service features. Autobooks Enterprise includes all features and services offered in Autobooks Embedded.

Includes all Embedded features above, plus:

Customer Features

Accounting

Reporting

Bill Pay

Cash Flow Management

Financial Institution Back Office

Customize Reporting

Customize Dashboards

Referral Management System

SSO Support

Unlimited Admin Users

Holding Company Management

Marketing

& Training

Assigned Implementation Specialist

Training Video Library

Embeddable LMS Modules

Ready to learn more? Contact Us

Four steps to a successful program

Offering integrated invoicing and online payment acceptance to your customers is a straightforward affair — thanks to the resources found here. Just follow the four steps below to ensure your Autobooks program is successful.

Step 1: Prepare to go live

1.1

Request access

Complete and submit the Autobooks forms below:

Complete the Operational Form

We need to know who to contact to best serve your team moving forward. This includes assigning your first team member with admin access to the Autobooks Hub, a tool that provides reporting to best serve your customers and successfully manage your program.

Confirm Banno Configuration

Log into the Banno Admin and confirm availability of the Accept Online Payments Plugin. If the Plugin is not available, contact Jack Henry to request the Plugin be added to your configuration.

1.2

Learn about Autobooks features & tools

Autobooks Feature Demos

A catalog of the most commonly used features of the Autobooks product suite.

Autobooks Hub

Our data-driven platform is crucial to maintain a successful program. Easily track Autobooks usage, ROI, and third-party competitor activity inside your financial institution.

1.3

Join our next Launch Workshop

Set your institution up for success

Along with the live, one-hour sessions, all attendees will receive ongoing support and resources — including scheduled office hours, step-by-step coaching and resources to get your program started right, promotional marketing materials, and more.

Autobooks Launch Workshop

Complete a launch with as little as two hours of commitment a week

1.4

Notify and Train your internal team

Send your team to attend a live training we facilitate, or if you prefer to train your team internally, we provide all the resources to download and use.

Autobooks Training Resources

Webinars, reference materials, internal go-to-market collateral, and more are all available on our training page.

Step 2: Configure & Test

2.1

Jack Henry has embedded and automated the technology to launch, so moving forward will be simple for your financial institution.

Banno Plugin Testing Guide

Step-by-step instructions to enable and test the plugins before you launch.

Getting Started Testing Guide

Discover how to configure and enroll a test user for Autobooks with our comprehensive testing guide. Explore Invoicing, Payment Link, Tap to Pay on iPhone, and our Accounting & Reporting functionalities.

Partner Success Center

Visit to get answers to frequently asked questions.

Step 3: Announce Your Launch

3.1

Market the new tool to your customers

Once you're live, marketing to your small business customers is key to drive feature awareness, engagement, and activation. We built free, proven marketing materials for your financial institution to use.

Marketing Kit: Autobooks Launch Announcement

Prepare a marketing campaign to announce the availability of Autobooks to your customers so they know about their new digital banking tool — and how to use it.

3.2

Plan for on-going campaigns

Financial institutions that see the best results execute ongoing marketing campaigns to drive awareness.

Autobooks Annual Marketing Calendar

Our annual marketing calendar is organized by quarters, to make it easier to organize a campaign at your financial institution. Please note that some campaigns are tied to seasonal events and Holidays, and may span multiple months.

Additional Go-to-Market Resources

Access evergreen marketing assets, videos, templates & campaigns to plug into your existing marketing initiatives.

Step 4: Manage Your Program

4.1

Access the Autobooks Hub & Stay Up-to-Date

Autobooks Hub

Log into the Autobooks Hub regularly to monitor the activity of your program. This allows you to measure success, identify new targets, and fine tune how you're talking to your small business customers that will benefit from online payment and digital invoice functions.

Autobooks Product Updates

Visit to learn about the latest product enhancements from the Autobooks team. We also include small business feedback and data insights that influenced each update.

Integrated payment acceptance, in action

Watch our demo at Digital Banking 2022, hosted by American Banker

At this year’s Digital Banking conference, Autobooks’ CMO, Derik Sutton, briefly discussed the small business market and demonstrated our integrated payment acceptance features to a live audience.

@

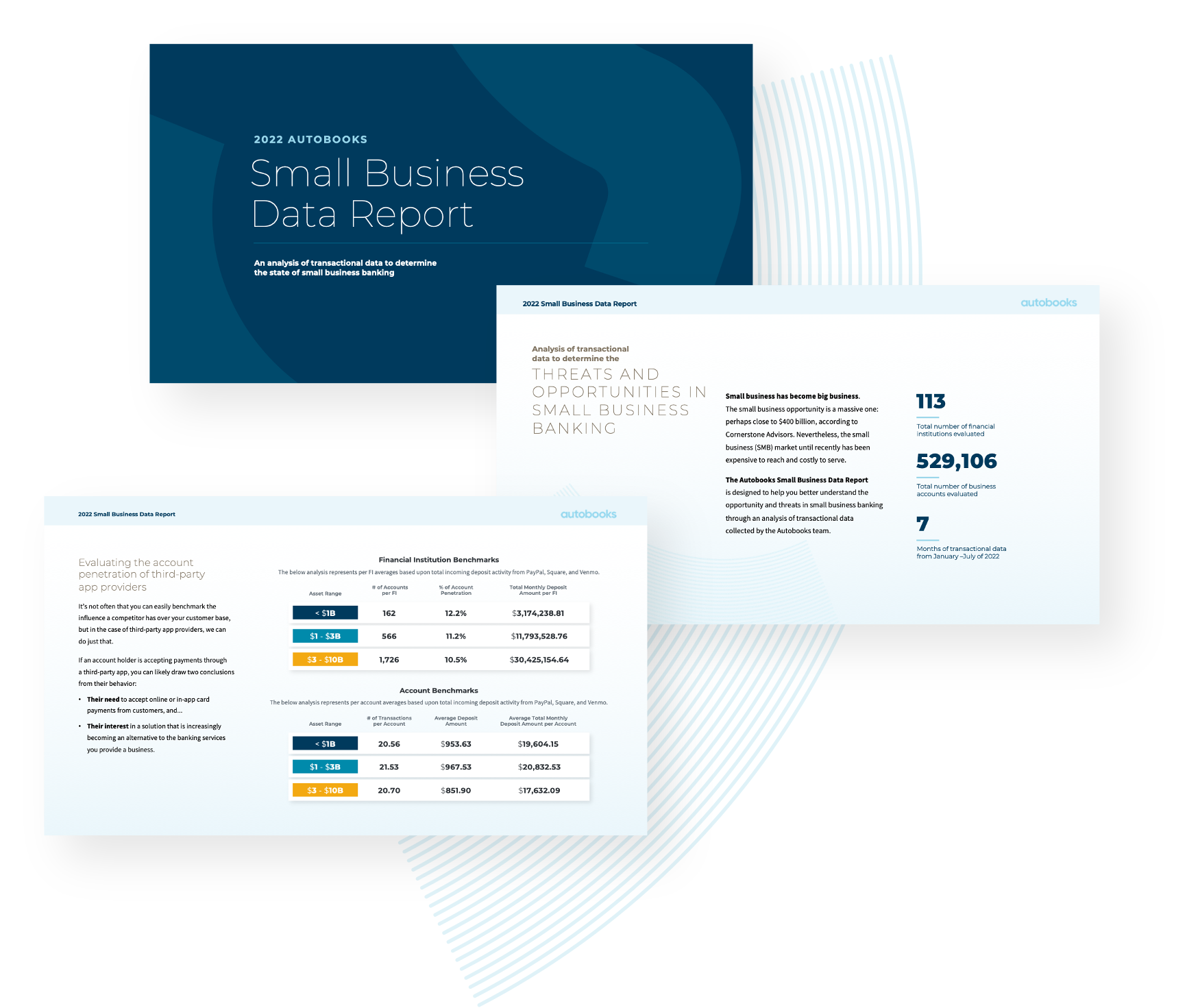

Small Business

Data Report

- Benchmark your small business portfolio against the third-party competition

- Compare yourself to other financial institutions

- Take action with our data and marketing tools to help thwart third-party apps

Meet us at Jack Henry Connect 2022

Booth #429/431

Breakout Session #239

Better Serve and Monetize Small Business Relationships

Tuesday, August 30

12:40 – 1:30 p.m. PST

Track:

Growing Revenue

Presenter:

Steve Robert

Co-Founder and CEO, Autobooks

When it comes to small business banking, there has been little clarity on what your institution needs to know — and do — to re-engage and monetize this crucial segment. For small businesses, it means that financial tools like electronic payment acceptance and cash flow management are now more crucial than ever for long-term success. For financial institutions, it means that business as usual will no longer cut it. FIs must place a greater focus on solving customer needs and pain points — starting now — if they are to continue to attract a new generation of small business owners. Join Steve Robert, Co-Founder and CEO of Autobooks, to learn how you can serve this market and become a small business hero.

Workshops

Evaluating your small business banking health

Tuesday, August 30

12:40 – 1:30 p.m. PST

Defining the banking needs of small business owners

Wednesday, August 31

11:35 a.m. – 12:25 p.m. PST

Building a better small business checking account

Thursday, September 1

2:50 – 3:40 p.m. PST