Portal Pay

Accept loan payments from any borrower, securely and digitally

Portal Pay gives your institution a fast way to accept ACH, debit, and credit card payments from borrowers without a deposit account. No login required. No complex integration required.

Why Portal Pay

Stop relying on checks and branch visits for loan payments. Portal Pay provides a secure, branded payment portal for all borrower types. It’s especially valuable for indirect lending and for borrowers who aren’t enrolled in digital banking.

How It Works

No complex setup. No core integration. No disruption to your current systems.

Two versions of the same experience:

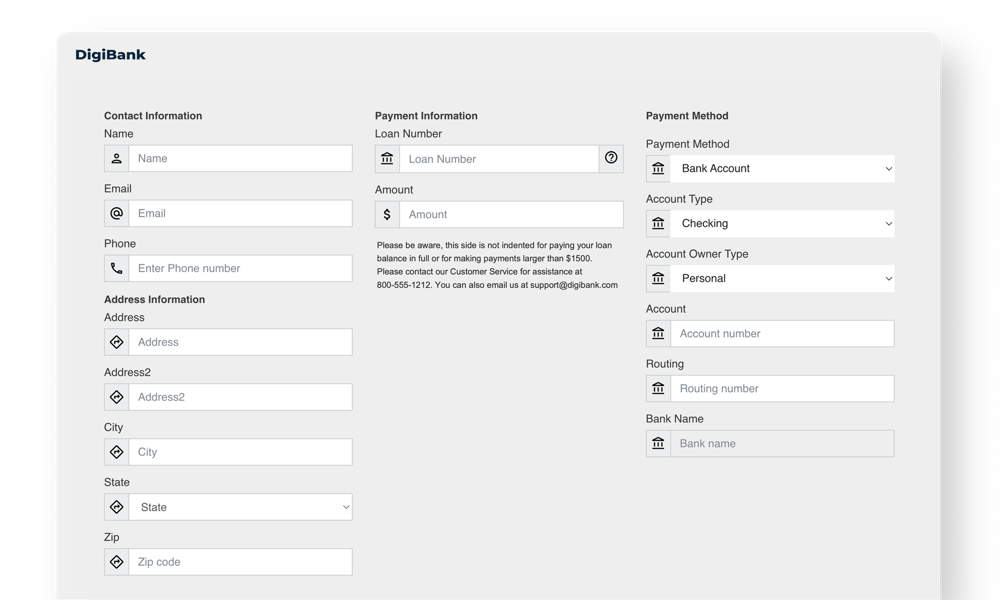

External-facing portal

Borrowers can make loan payments via ACH or card from any financial institution. No login required.

Internal-facing portal

Your team can securely enter payments when assisting borrowers by phone or in person

You get a flexible, branded payment link you can:

Add to your website

Include in email reminders

Send via SMS when assisting a borrower

Why It Matters

Portal Pay helps your institution:

Improve borrower experience with fast, flexible digital repayment options

Reduce operational friction and eliminate paper check handling

Increase on-time payments and improve collections

Consolidate vendors and reduce costs

Optionally generate fees for certain payment methods

Frequently asked questions

How does the integration between Autobooks and my financial institution work?

How does the integration between Autobooks and my financial institution work?

We’ve partnered with the industry’s leading digital banking providers to integrate our product suite into their existing platforms. That means that when your customers log into their account, the payment acceptance features powered by Autobooks will be available from the main dashboard or navigation, like bill pay and mobile deposit are today.

How would Autobooks complement our existing merchant services program?

How would Autobooks complement our existing merchant services program?

Not all businesses operate in traditional retail environments. Many businesses and non-profits need to accept card payments in app and on the move, such as through an online link shared online or by text message, or through a digital invoice. Autobooks enables your financial institution to offer these capabilities so that you can serve customer segments that are not fit for traditional merchant services and treasury products.

What’s the benefit when our customers get paid through Autobooks, versus a third-party payment acceptance app?

What’s the benefit when our customers get paid through Autobooks, versus a third-party payment acceptance app?

When businesses utilize Autobooks for receiving payments, it's akin to solidifying the direct deposit relationship of a consumer account. When the business gets paid through a service you offer, funds are deposited directly into your customers' accounts. Ensuring you lock in the full deposit relationship. This is not always the case when a customer uses a third-party app. In fact, most third-party apps compete with you for the customer deposit, transaction processing revenue, and lending opportunity.

How much do you charge for Autobooks?

How much do you charge for Autobooks?

There are two types of fees associated with Autobooks: processing fees and monthly subscription fees. When a customer incurs either type of fee, a portion of the revenue is shared back with the financial institution.

Processing fees are charged on a per transaction basis when a customer accepts a payment through Autobooks invoicing, payment links, or Tap to Pay on iPhone. Refer to our fees page for pricing details.

Subscription fees are charged on a monthly basis only for customers that opt for the full Autobooks product suite that includes accounting, financial reporting, and payment acceptance functionality. The monthly subscription fee for the full Autobooks product suite is $9.99 a month.